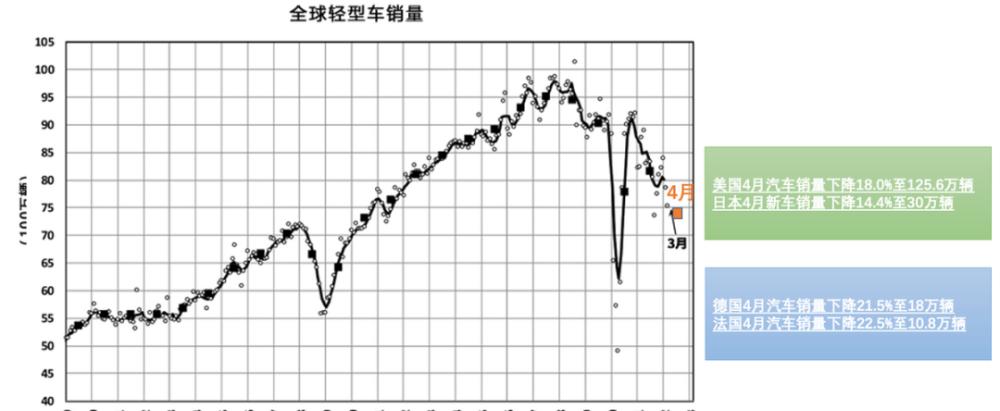

Global auto sales declined in April, a trend that was a bit worse than LMC Consulting's forecast for March. Global passenger car sales fell to 75 million units/year in March with seasonally adjusted annualized sales, and global light vehicle sales fell 14% year-on-year in March.

The U.S. was down 18% to 1.256 million units

Japan was down 14.4% to 300,000 units

Germany was down 21.5% to 180,000 units

France fell 22.5% to 108,000

If we estimate the situation in China, if according to the estimates of the Federation of Passenger Vehicles, the retail sales target of car companies in April fell sharply year-on-year, and the retail sales of passenger cars in the narrow sense are expected to be 1.1 million units, down 31.9% year-on-year, according to this calculation, the entire global passenger car decline in April 2022 to about 24%.

Figure 1. With an overview of global passenger car sales, the automotive industry is in a weak cycle

From the perspective of the entire new energy vehicle:

April sales of 43,872 units, down -14% year-on-year and -29% month-on-month, and April sales of 22,926 units increased by 10% year-on-year and decreased by 27% month-on-month. The UK's data has not yet come out, the situation of new energy vehicles in April is basically sideways, and the growth situation is not very good.

Figure 2. Sales of new energy vehicles in Europe

Part 1

Year-on-year data overview

From the Perspective of Europe, the main markets of Germany, France, Italy and Spain are declining, and there is a high probability that car sales in the United Kingdom will also decline, and the correlation between car consumption and the macroeconomic environment is too large.

Figure 3. Compared with the total in April 2022, car consumption in Europe is weakening

If the total amount of decomposition, HEV, PHEV and BEV three points of view, pure electric in various countries is not particularly obvious decline, PHEV due to supply reasons fell quite large.

Figure 4. Year-on-year data by type for April 2022

Germany's pure electric vehicles 22175 units (-7% year-on-year, -36% month-on-month), plug-in hybrid sales of 21697 units (-20% year-on-year, -20% month-on-month), the total penetration rate of new energy vehicles in the month was 24.3%, up 2.2% year-on-year, which is a very small month in Germany

France's pure electric vehicles 12,692 units (+32% yo-on-year, -36% q-o-q), plug-in hybrid sales of 10,234 units (yo-y -9%, mo-m-12%); the penetration rate of new energy vehicles in the month was 21.1%, an increase of 6.3% year-on-year

Other markets Sweden, Italy, Norway and Spain were generally in a state of low growth.

Figure 5. BeV vs. PHEV in April 2022

From the perspective of penetration, in addition to Norway to achieve a high penetration rate of 74.1% of pure electric vehicles; several large markets in the 10% penetration rate of pure electric vehicles, in the current economic environment to go further ahead, the price of power batteries is also continuing to rise.

Figure 6. Permeability of BEV and PHEV

Part 2

A question of supply and demand this year

Europe is facing problems, on the supply side due to the supply problems of chips and Ukrainian wire harness companies, the supply of vehicles has risen due to insufficient supply; while the increase in inflation has led to a decline in real incomes, a surge in gasoline prices, and the threat of rising potential unemployment caused by the increase in operating costs of enterprises.

In the latest report, the cost of the automotive industry began to shift, and Bosch said that the increase in raw material, semiconductor, energy and logistics costs needed to be borne by customers.

Auto supplier giant Bosch is renegotiating contracts with automakers to increase what it charges them for supplies, a move that could mean car buyers will see yet another boost on window sticker prices during this pandemic.

Figure 7. The price transmission mechanism of automotive industry parts to car companies has begun

Summary: I think the ultimate possibility is that the price of automobiles will continue to rise for a period of time, and then differentiate the demand according to the actual situation of product strength and sales terminals; in this process, the scale effect of the automobile industry is weakening, and the scale of the industrial chain is determined according to the demand, and the profit margin of the industrial chain will be compressed for a period of time. A bit like the era of the oil crisis, it is necessary to find companies that can support the past, and this period is the liquidation stage of the market elimination period.