Continue to study the Pfizer special drug industry chain today:

It was found that catalysts were needed in multiple chemical synthesis steps, one of which was called platinum dioxide.

Further looking in the listed companies, there is only one exclusive authentic company, called Kaili New Material.

Because it is a new stock that has not been listed for a long time, and it is a science and technology innovation board, it is not very familiar. A chemical stock, doing chemical catalysts, the market is not familiar.

But!!!

Then we studied in depth and found a new world, first of all, we looked at his revenue:

Most of the main business is in the pharmaceutical industry, which is the upstream of the pharmaceutical industry.

Open the Prospectus:

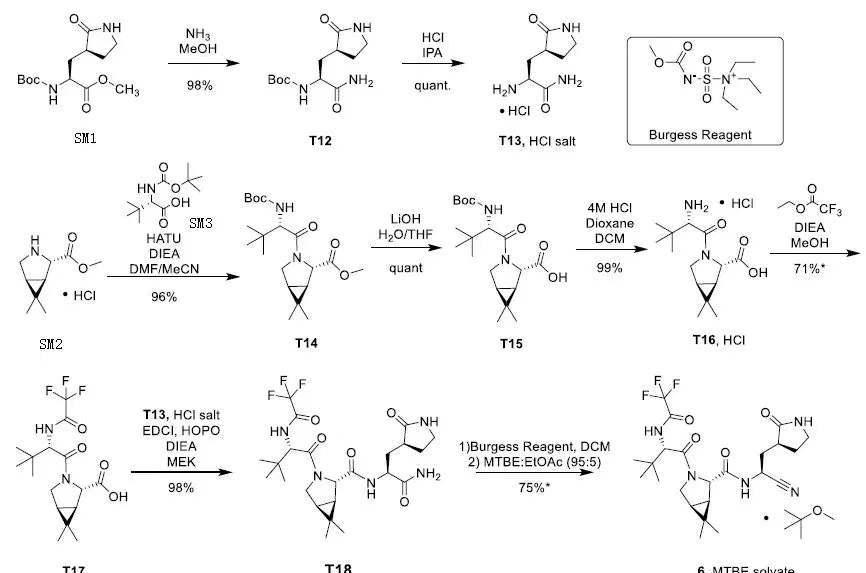

(Ritonavir is included in the image above)

(Both ritonavir and oseltamivir are required)

Well, this is a treasure boy.

Chemical synthesis drugs basically use the company's catalysts.

Then let's look at the December institutional survey minutes:

The company's downstream pharmaceutical customers are basically small molecule chemical synthetic pharmaceuticals. It should be known that Pfizer special drugs are small molecule chemical synthetic drugs.

Moving on, in the November study:

The revenue growth rate of the pharmaceutical sector has reached 40%-50%, which is very fast, but the API and CXO are not counted separately.

But the agency is very sophisticated, you don't answer my question in a different way, is to find out whether this increase mainly comes from the raw material drug or CXO (CMO).

Because Pfizer's special drugs are all produced by CXO (CMO) pharmaceutical companies in China, such as WuXi AppTec, GloriaIn, Boteng shares, etc.

The point is, when the report is in the middle, that is, the CXO accounted for 14% in the first two quarters, and the third quarter accounted for 17%.

It shows that most of the growth of the pharmaceutical sector during this period is provided by CXO (CMO) pharmaceutical companies, or that in medicine, the growth rate of CXO (CMO) is greater than that of raw material drugs.

Further down, revenue increased significantly in the third quarter:

In the third quarter, it achieved a turnover of 510 million, an increase of 118% year-on-year.

The company's catalyst, in addition to pharmaceuticals, is the chemical industry, but the third quarter of the downstream chemical industry is the maintenance season.

That revenue growth, mainly from the pharmaceutical industry, then it can be determined that the company's third quarter pharmaceutical industry growth rate is not less than 118% year-on-year, not less than 30% month-on-month.

According to the company's business situation and the company's research disclosure, it can be basically clear that the company's homogeneous (high metal content, resulting in a decline in gross profit margin) catalyst products, generated explosive growth, directly contributed about 200 million revenue.

PS: The company's catalysts are divided into homogeneous and multiphase according to the application.

The company's homogeneous catalyst, basically based on platinum technology, rhodium (the price is too high, if it is put in volume, the gross profit margin will decline faster) The amount of iridium is particularly small, and the metal price of ruthenium is relatively low, which does not meet the situation of gross profit margin reduction, so the probability is the homogeneous pharmaceutical direction catalyst of platinum.

Back to the second picture at the top:

Platinum dioxide is used in the chemical synthesis of Pfizer drugs. Through the above analysis, the company's growth mainly comes from platinum catalysts.

In summary, it can be considered that this homogeneous catalyst produced explosive revenue growth in the third quarter, and the third quarter was also the starting point of the surge in supply chain companies such as Feikai, Yaben Chemical, and Jingjing Pharmaceutical, and it was also the location of the company's sudden revenue fault.

Moreover, in terms of the competitive landscape, almost all small molecule antiviral drugs use precious metal catalysts.

The company is also the leader of pharmaceutical catalysts in China, almost alone (there is another one that is not listed, but the proportion of the pharmaceutical industry is not high).

There is reason to believe that not only PF-07321332 and ritonavir, but also the catalyst of the company needs to be used.

In the future, almost all the new crown small molecule therapeutic drugs will use the company's catalyst, and the company's main pharmaceutical business will usher in a new leap-forward development.

At last

Let's have an Easter egg

Tianfeng Securities has a research report on Kaili New Materials:

The target price directly gives 174 yuan, and the current price is only 110 yuan.

PS: Note that when the research report came out, there was no incremental expectation brought by the specific drug at that time.

This stock should be a very authentic stock in the special drug industry chain, which will definitely benefit. Because it is a new and a science and technology innovation board, the market pays less attention, and there is a huge expectation difference here!